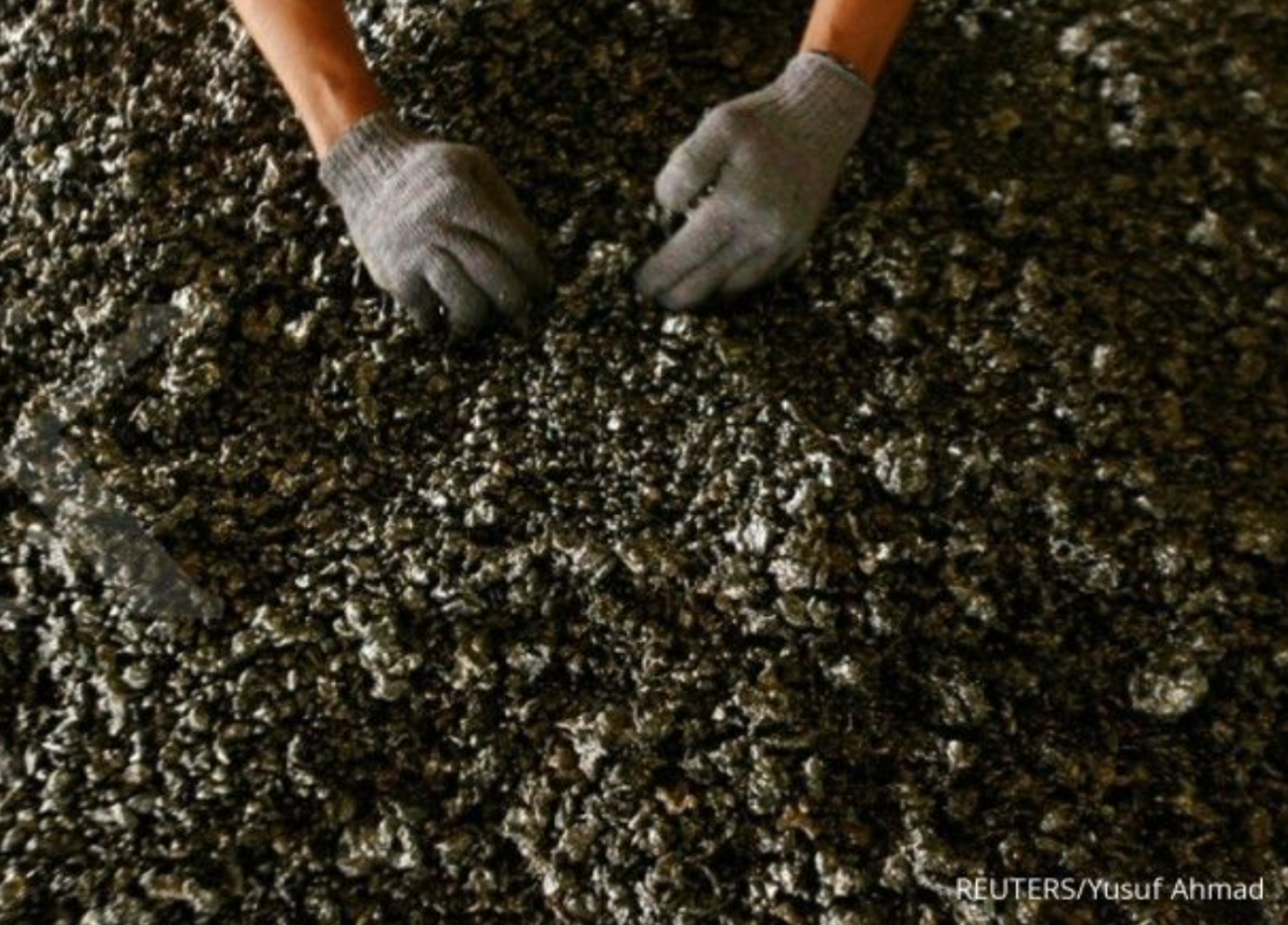

This year, PT Bayan Resources Tbk. (BYAN) targets revenue to reach USD 3.6 billion, or around IDR 55.80 trillion, in line with the increase in coal production and sales. The information was conveyed by the company in its press release in Jakarta yesterday.

Bayan targets revenue in 2024 to reach USD 3.3 billion–USD 3.6 billion, or around IDR 51.15 trillion–IDR 55.80 trillion (estimated exchange rate of IDR 15,500 per US dollar). The estimated EBITDA ranges from USD 1.2 billion-USD 1.4 billion or around IDR 18.6 trillion-IDR 21.7 trillion. It is stated that coal production in 2024 will be 55 million–57 million tons, up from the estimated realization in 2023 of 48 million tons.

In addition, the company also predicts that Newcastle coal prices in 2024 will be around USD 110 per ton, and ICI4, on average, will reach USD 58 per ton. It is expected that the coal price will be more stable after declining last year from its peak in 2022. The average selling price (ASP) of BYAN coal in 2024 is estimated to range from USD 60-USD 65 per ton, corrected from USD 76 per ton in 2023, USD 118 tons in 2022, and USD 71 per ton in 2021. However, the selling price is still better than in 2020 at USD 39 per ton and USD 48 per ton in 2019.

To maximize profits, Bayan will keep the cost at around USD 40–43 per ton. These costs include the cost of goods sold (COGS), or all costs incurred by the company in each production activity; selling, general, and administrative expenses (SGA), or operational, business, and royalty costs. In 2024, BYAN will allocate a capital expenditure (capex) of USD 230–USD 260 million, or around IDR 3.56 trillion–4.03 trillion (estimated exchange rate of IDR 15,500 per US dollar).

The capex allocation is 74% for development and infrastructure, 13% for equipment and machinery, and 13% for other equipment purchases. BYAN management said it would spur coal production in 2024 to 55 million-57 million tons. Thus, BYAN's production volume continues to increase from 2023 48 million tons, 2022 39 million tons, 2021 38 million tons, and 2020 30 million tons. It is mentioned that coal production volume in 2024 has the potential to increase by 15%-20% due to the expansion of the North Pakar mine in Tabang.

BYAN is the third largest coal producer in Indonesia, below PT Bumi Resources Tbk. (BUMI) with around 80 million tons of production, and PT Adaro Energy Indonesia Tbk. (ADRO), with around 64 million tons. On a quarterly basis, BYAN's production volume in the first quarter of 2024 is estimated at 10 million-11 million tons, the second quarter of 2024 13 million-14 million tons, the third quarter of 2024 16 million-17 million tons, and the fourth quarter of 2024 14 million-15 million tons.

In terms of sales volume, BYAN also targets coal marketing of 55 million-57 million tons in 2024, up 15%-20% from the estimated sales realization in 2023 of 47 million tons. Meanwhile, last year coal sales also rose from the realization in 2022 of 40 million tons. As of September 2023, Bayan Resources' coal market composition is the Philippines 32%, Indonesia 22%, South Korea 10%, China 9%, India 8%, Bangladesh 6%, Malaysia 5%, and other markets 8%.

Until the end of 2023, BYAN has pocketed a sales commitment of up to 45.5 million tons for the 2024 period with a calorie specification of 4,324 GAR Kcal/kg. About 84% use floating prices, and 16% use fixed prices. "The sales commitment has reached 80%-82% of sales plans throughout 2024," explained BYAN's management.

Image source: www.neraca.co.id

Source: www.neraca.co.id/Produksi Tambang Tumbuh - Bayan Resources Targetkan Pendapatan US$ 3,6 Miliar

Image source: www.neraca.co.id

Source Link: https://www.neraca.co.id/article/193299/produksi-tambang-tumbuh-bayan-resources-targetkan-pendapatan-us-36-miliar