GOLD miner Wilton Resources : 5F7 +11.11% has sold some 742 million shares in its subsidiary Wilton Makmur Indonesia for about S$3.5 million in cash, effectively reducing its stake in the company from 91.34 per cent to 86.56 per cent.

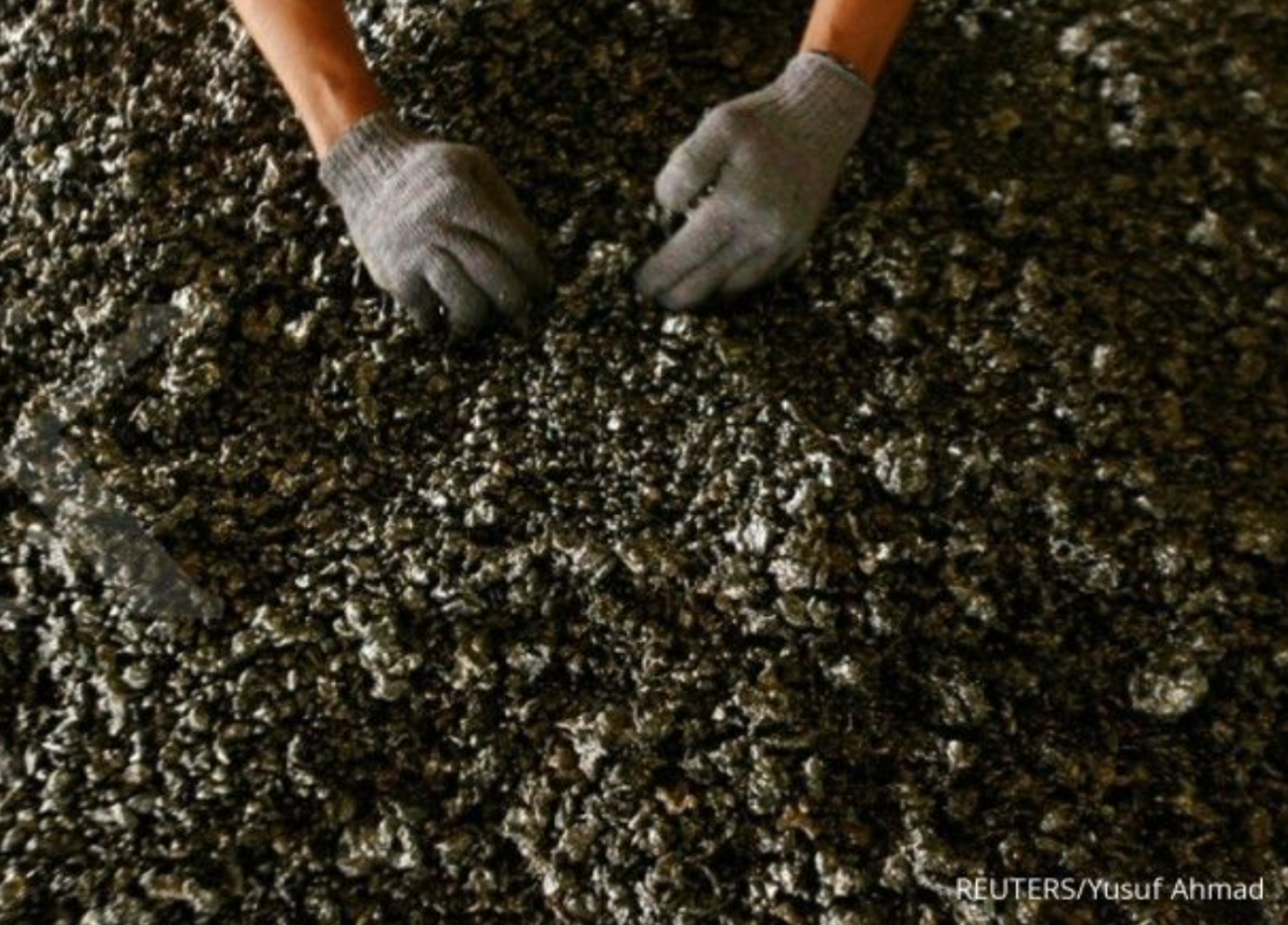

In its announcement on Monday (Apr 4), Wilton Resources said it intends to use net proceeds from the sale to fund leaching activities at its processing facility at its Ciemas Gold Project in West Java, Indonesia.

Proceeds will also be used to fund the progress construction of a 500 tonnes-per-day flotation and carbon-in-leach mineral processing facility at the project, and for general working capital purposes of the group.

Highlighting that it had a negative working capital of 87.49 million rupiah (S$8.3 million) as at end-2021, the group said its sale of shares in Wilton Makmur enables it to raise funds within a short period of time to increase its working capital, which is needed to fund its construction activities for the Ciemas Gold Project.

Wilton Makmur is an investment holding company listed on the Indonesia Stock Exchange. Its subsidiaries are principally engaged in gold mining activities in Indonesia.

The purchasers are Chong Thim Pheng, executive chairman of Hotel Re! Singapore and a substantial shareholder of Wilton Resources, as well as his son-in-law Ong Kok Heng. Ong is currently director at fund management company Euro Asia Asset Management.

Chong and Ong have also been granted an option to buy 530 million more shares in Wilton Makmur, representing a further 3.41 per cent interest in the company, for S$3.5 million in cash with a put option.

About S$7 million in net proceeds from both the sale and option shares in Wilton Makmur collectively represent a loss of S$1.5 million over their open market value as at Mar 28, 2022, and a gain of S$5.5 million over their book value as at Dec 31, 2021.

Based on the unaudited financial statements of Wilton Resources for the fiscal year ending Dec 31, 2021, the net loss attributable to the sale and option shares in Wilton Makmur amounted to 860 million rupiah and 610 million rupiah, respectively.

Shares of Catalist-listed Wilton Resources ended flat at S$0.017 before the group requested for a trading halt on Mar 30, pending its release of the announcement. Its shares resume trading today.