PT Bukit Asam (Persero) Tbk (PTBA) has unmonetized coal reserves of 3 billion tons with a production rate of 35 million tons per year. However, the company is faced with an industry trend towards a transition to new and renewable energy (NRE). How does PTBA respond to these challenges?

VP of Downstream Development of PT Bukit Asam Tbk Setiadi Wicaksono said that in the context of the energy transition trend and its relation to the coal industry, the company observed four main factors.

First, the cyclical factors of the global economy that will drive new demand for coal relatively come from developing countries in the long term. Second, the direction of net zero emissions (NZE) which will trigger the demand for coal commodities to decline.

Meanwhile, the next factor is the energy revolution which makes the portion of NRE in the future more significant, which has a direct impact on the decline in coal. The last factor is about ESG.

According to Setiadi, the current ESG factor is very important considering that it deals with funding where global creditors have avoided types of investments that are not environmentally friendly.

Facing industry challenges and the company's target of monetizing coal reserves of 3 billion tons, PTBA also prepared a long-term plan consisting of four pillars. The first pillar relates to the coal business, while the other three pillars concern the company's efforts towards an energy transition.

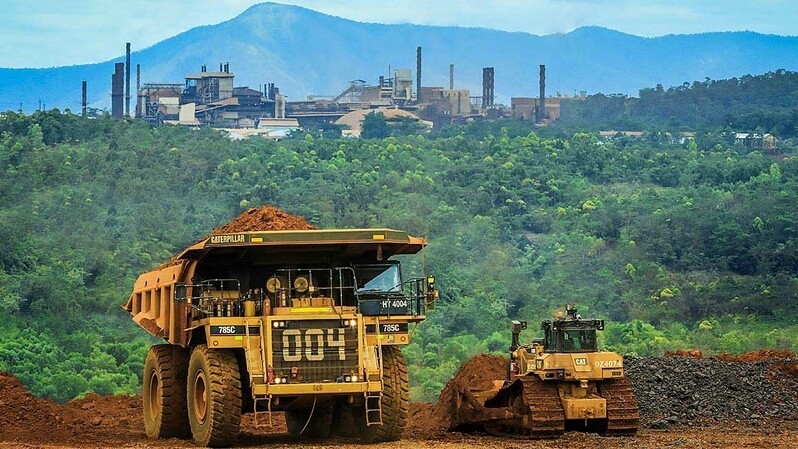

Setiadi explained, in the first pillar, Bukit Asam will increase capacity in line with the large amount of coal reserves that have not been monetized at the company's sites. "So, if we look at 2060, it is already the out phase of NZE, while our reserves are still a lot. So, like it or not, we have to increase production capacity," he said at the E2S Outlook for the ESDM Sector 2023 & E2S Awards 2022, Tuesday (12/13/2022).

For this reason, PTBA targets an increase in coal transportation capacity in Tanjung Enim to double capacity in 2027.

The second pillar, focus on the energy transition. This member of the Mining Industry SOE Holding admitted that he had begun to penetrate into the renewable energy segment. One of them is by building solar power plants on the company's post-mining lands.

"Regarding the energy pillar, we are also developing several projects. First, the post-mining solar power plants in several sites if we total the area and potential megawatts can reach 630 megawatts are in the feasibility study phase and we must convey it to PLN, hopefully there can be a good response from PLN," setiadi explained.

Furthermore, the company is also developing the Mine Mouth Power Plant-Sumsel 8, whose progress has now reached 97% and is expected to be able to operate commercially (commercial operation date / (COD) next year. Meanwhile, for rooftop solar power plants, we synergize with AP II at Soekarno-Hatta Airport, as well as toll road solar power plants through synergy with PT Jasa Marga Tbk.

The third pillar is the question of chemistry, especially with regard to coal-to-DME as an alternative to LPG as campaigned by the government. Setiadi ensured that the company is currently continuing the process of getting there by building an industrial center based on downstream energy. He also hopes that through this project Bukit Asam can contribute to reducing LPG import subsidies, which are quite fantastic in value.

As for the last pillar of carbon management, Setiadi said that the company also decarbonizes mining through the use of electric-based mining vehicles.

This also proves that the company strives to contribute to capturing carbon emissions and reducing carbon emissions. This includes implementing an e-mining reporting system so that it contributes to the efficiency of fuel consumption up to 10.8 million liters.

"From these initiatives, our estimated concentration for fuel consumption reaches 10.8 million liters per year. This is a high enough value for gasoline savings and will automatically provide efficiency in terms of cost," concluded Setiadi.

Image source: Beritasatu.com