ITMG Earns IDR 4.6 Trillion Profit in HI/2023

Wed 16 Aug 2023, 12:00 PM

Share

PT Indo Tambangraya Megah Tbk. (ITMG) recorded a decrease in net profit to IDR 4.61 trillion in the first half of 2023, in line with the correction in revenue.

ITMG's revenue in semester I/2023 reached US$1.29 billion or the equivalent of Rp.19.51 trillion (estimated exchange rate of Rp.15,026 per US dollar). This revenue is lower than in semester I/2022 which penetrated US$1.42 billion or around Rp.21.15 trillion.

This net income was obtained from a subsidiary of PT Indominco Mandiri (IMM) of US$412.30 million, down 9.64 percent compared to the first half of 2022 which reached US$456.30 million. Meanwhile, PT Trubaindo Coal Mining (TCM) contributed US$345.53 million, down 24.21 percent compared to semester I/2022 of US$455.92 million.

Based on market segment, sales to Taiwan, China, Hong Kong and Korea were the biggest contributors with a value of US$452.79 million. Then the Southeast Asian market contributed US$377.20 million, Japan US$231.90 million and the domestic market US$205.53 million. ITMG also recorded exports to the European market with a value of US$31.74 million from US$0 in the first half of 2022.

The increase in ITMG's revenue also contributed to an increase in cost of revenue by 25.07 year-on-year (YoY) to US$840.94 million from US$672.38 million.

This increase in cost of revenue made ITMG's gross profit eroded 38.83 percent to US$458.24 million from US$749.16 million.

As a result, profit for the year attributable to owners of the parent entity or ITMG's net profit fell 33.42% YoY from US$460.68 million in the first semester of 2022 to US$306.70 million or Rp.4.61 trillion in the first semester of 2023.

ITMG previously targeted sales volume this year to reach 21.5 million-22.5 million tonnes or double-digit growth from the realization in 2022. The company is also targeting export expansion to the European market this year.

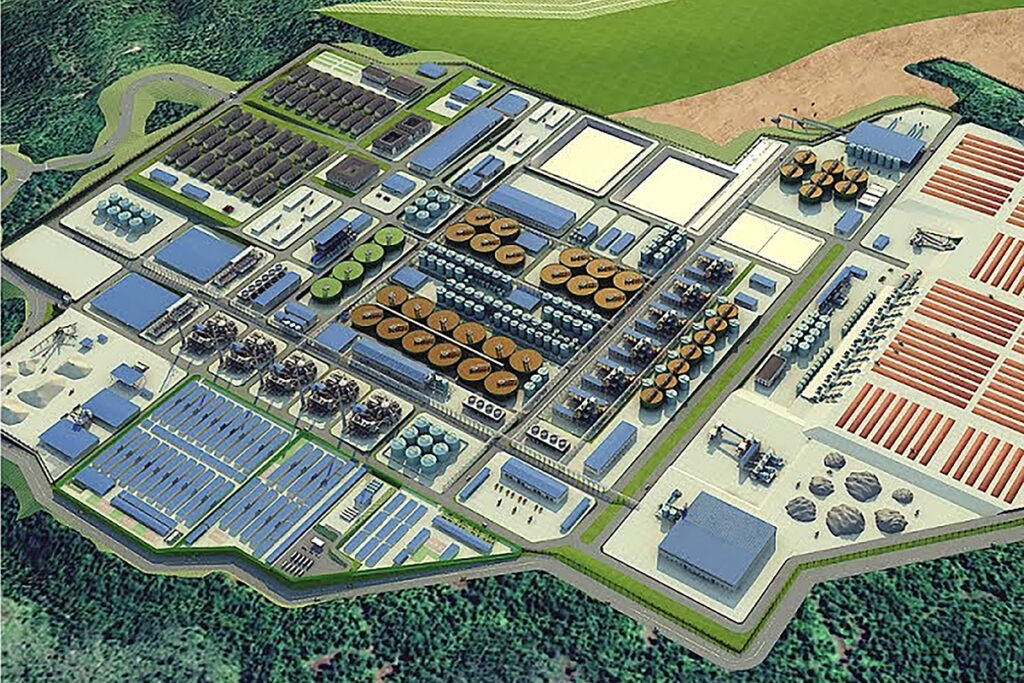

Image source: itmg.co.id