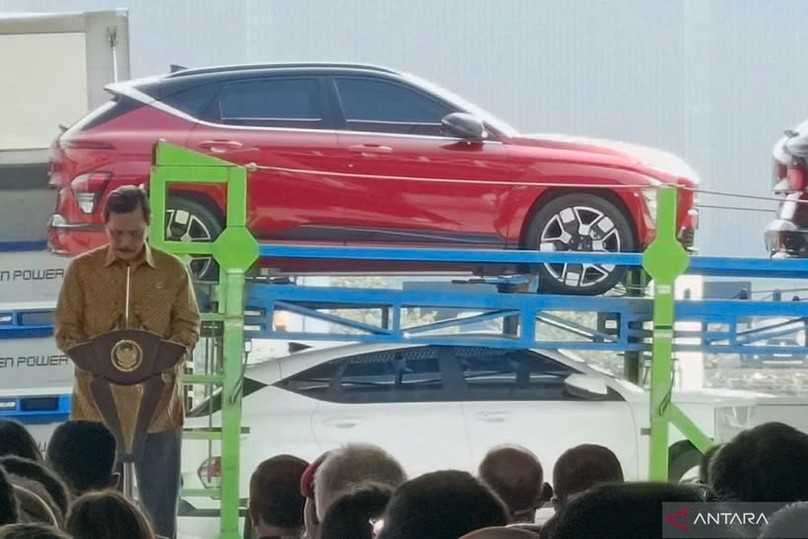

China continues investment support in Indonesia's electric vehicle industry

www.china.org.cn

3121 Views

China continues to expand its investment to support the development of Indonesia's electric vehicle industry. Contemporary Amperex Technology (CATL), one of the leading companies among the world's electric vehicle battery manufacturers and supplies to various automakers, including Tesla and Volkswagen, is one of the Chinese companies investing in this Southeast Asian country.A third-tier subsidiary of CATL, Ningbo Contemporary Brunp Lygend Co., Ltd. (CBL), recently signed a 5.97-billion-U.S. dollar investment deal with Indonesia Battery Corporation (IBC), a holding of state-owned companies including Mining Industry Indonesia (Mind ID), Aneka Tambang (Antam), Pertamina, and state power company PLN."The realization of this investment will bring the electric vehicle battery industry to Indonesia as well as position Indonesia as a global electric vehicle battery production base," President Director of IBC Toto Nugroho told Xinhua recently.IBC, inaugurated in March last year, was established to develop an integrated electric vehicle battery industry ecosystem, from upstream to downstream, to mining and nickel extraction. With China investors as global players in the development of electric vehicle batteries and Indonesia's rich reserve of battery-making raw materials like nickel, Nugroho believes that the cooperation between the two countries will synergize and strengthen each other.Indonesia is estimated to have deposits of at least 72 million tons of nickel reserves in areas of domestic mining operations, accounting for 52 percent of the world's total reserves of around 139 million tons, according to data from the country's Ministry of Energy and Mineral Resources. Nugroho believes that the cooperation between the two countries will support Indonesia's serious intention to reduce greenhouse gas emissions and increase the use of renewable energy."Besides CATL, many other Chinese companies are now investing in electric battery development in Indonesia. China is one of Indonesia's significant investment partners, we hope this cooperation will continue to increase and cover wider fields, including the development of electric vehicles and renewable energy," he said.As the country with the most consumers in Southeast Asia and supported by the world's largest nickel reserves, Indonesia has a bright opportunity to become a major player in the global electric vehicle sector, said Chairman of the Association of Indonesian Automotive Industries (GAIKINDO) Yohannes Nangoi."Moreover, more people will switch to electric vehicles in the future as fossil fuels damage our environment and cannot be renewed," Nangoi added. Currently, the use of electric vehicles is limited within cities and for short trips. In the future, with increasingly developed technology, electric vehicles will be used for longer distances and various types of vehicles, including trucks transporting commodities between provinces or islands.The problem is that electric vehicles currently are more expensive than conventional ones, but Nugroho believes this will be solved if the batteries meet three conditions: charging quickly, storing more power, and being cheaper. "It is just a matter of time, as to how fast the experts or mechanics can achieve these three main things," he said.The support of leading Chinese companies in this field will help Indonesia achieve the goal. "Those Chinese companies dare to invest in large amounts in Indonesia. Cooperation between the two countries has great prospects," Nangoi added. EnditemSource: http://www.china.org.cn/world/Off_the_Wire/2022-06/21/content_78282384.htm