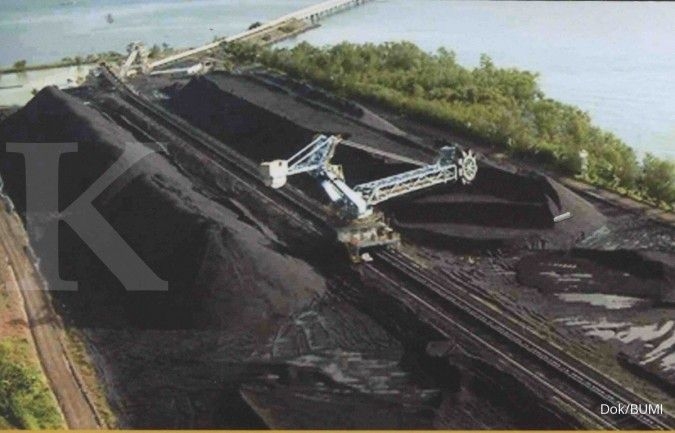

Bumi Resources (BUMI) Coal Production up to 36 million tons

Wed 06 Jul 2022, 15:02 PM

Share

The La Nina phenomenon and heavy rainfall overshadowed the coal production of PT Bumi Resources Tbk (BUMI) until the mid-year period. The Bakrie Group coal mining issuer has also reconsidered its production target until the end of 2022. BUMI Director and Corporate Secretary Dileep Srivastava said that his party had not released the results of operational performance in the first half of 2022. However, as an estimate, BUMI's coal mining and sales volume for six months reached around 35 million - 36 million tons.

Dileep said La Nina and high rainfall since December 2021 are still hampering the production process. BUMI also targets coal production to reach 79 million - 83 million tons this year. The target is slightly higher than in 2021 with a volume of around 78 million tons. However, BUMI's current target is below previous expectations of pursuing production of 81 million - 86 million tons until the end of 2022.

Dileep said that his party is considering weather factors, which are estimated at 50-60 percent of the potential for heavy rains to continue in the second half until next year. He emphasized that BUMI will pursue the target while fulfilling its domestic supply obligations, aka Domestic Market Obligation (DMO). "If the La Nina rains subside, we hope to reach the 2022 guidance as outlined. We are on track to meet the DMO," Dileep told Kontan.co.id, Wednesday (6/7).

Meanwhile, BUMI's coal production will be supported by its two subsidiaries, namely PT Kaltim Prima Coal (KPC) and PT Arutmin Indonesia. KPC contributed higher with an estimated ratio of 2:1. In terms of sales, Dileep sees that coal demand is still strong in the second half. The effects of the Russo-Ukrainian war are still a driving factor as sanctions on the supply of fossil fuels originate from Russia.

Therefore, the European Union market can be considered in the second half of this. However, there are a number of challenges that need to be addressed first. First, the weather factor that can hinder production operations. Second, the specifications of the coal produced and its mixture in certain markets. Third, the priority to fulfill the DMO.

The fourth challenge is the limited funding support from banks or financial and investment institutions. "This can be detrimental to resolving the energy crisis as well as to managing energy security and orderly transitions," Dileep said. In the midst of the position of coal prices which are still at a high level, BUMI has also accelerated debt payments. BUMI paid Tranche A in full in Q4 2022 and initiated significant payments from Tranche B, in addition to converting Mandatory Convertible Bonds (MCBs) into equity.

"Thus significantly reducing interest costs to be able to increase profits with a more balanced capital structure," explained Dileep. BUMI also held an additional capital without giving the right to pre-emptive securities (PMTHMETD) aka private placement . In this corporate action, BUMI will issue 13,206.473,996 Series C shares with a nominal value of Rp 50 per share. This amount represents 10.25% of BUMI's total shares prior to the private placement .

The exercise price will be held at Rp 76.59 per share. Thus, the value of this private placement transaction reached Rp 1.01 trillion, which was intended to convert Innovate Capital's debt. "We hope to have a balanced capital structure after the current proposed corporate action and expect our 2022 performance to be far superior to 2021," concluded Dileep.

Source: https://investasi.kontan.co.id/news/bumi-resources-bumi-produksi-batubara-hingga-36-juta-ton-pada-semester-i