Habco (HATM) Profit Increased 236% Reaches IDR 66.79 Billion

Tue 16 Aug 2022, 07:24 AM

Share

PT Habco Trans Maritima Tbk (HATM) posted a 236.30% surge in profit for the year from Rp 19.86 billion to Rp 66.79 billion in the first semester of 2022. The increase was in line with the increase in income. The company's revenue shot up from Rp 85.64 billion to Rp 178.92 billion as of June 2022. The surge in profits also resulted in an increase in the company's basic earnings per share from Rp 7.09 per share to Rp 11.93 per share.

The company in its information disclosure also stated that Habco's operating profit also increased from Rp 20.15 billion to Rp 69.27 billion. Foreign exchange financial income also rose to Rp 1.01 billion. The company recently managed to raise Rp 179 billion in fresh funds from the initial public offering (IPO) of shares. Meanwhile, the company's total public offering, including debt conversion, and the ESA program reached Rp 224 billion.

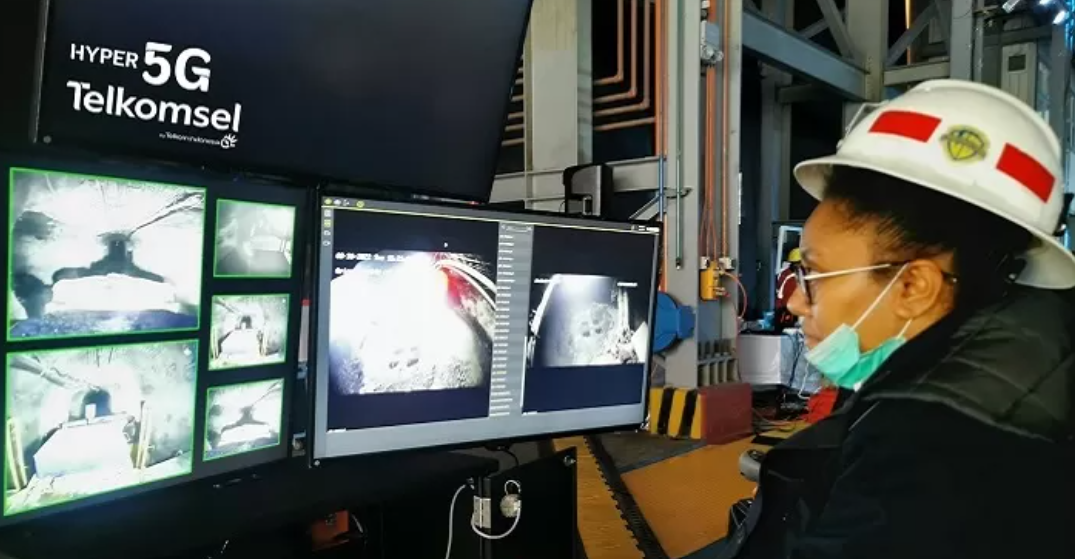

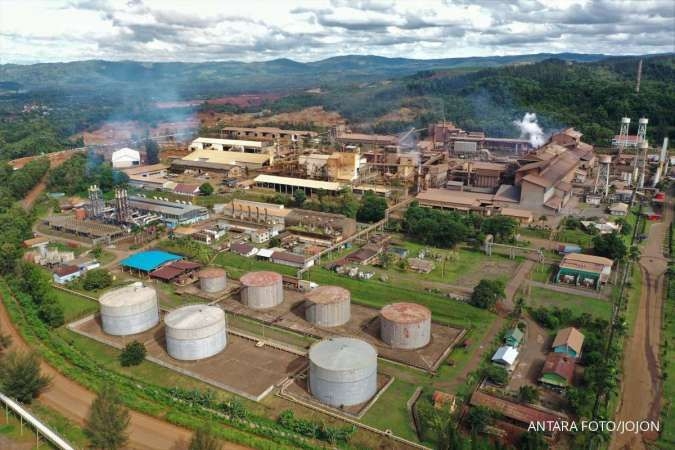

All fresh funds obtained from the initial public offering will be used by HATM to purchase a new fleet of bulk carriers , due to high market demand, especially in the energy supply chain industry. As an example, the company together with PT Dwi Guna Laksana Tbk (DWGL) collaborated in transporting coal supplies to several power plants in Indonesia to support the availability of electricity in various regions. The company has also served transportation for the nickel plant owned by the Tsingshan Group operating in Indonesia.

Source: https://investor.id/market-and-corporate/303312/melesat-236-laba-habco-hatm-capai-rp-6679-miliar

Source: https://investor.id/market-and-corporate/303312/melesat-236-laba-habco-hatm-capai-rp-6679-miliar