Adaro's Dividend (ADRO) of IDR 7.8 Trillion on 30 December

Fri 06 Jan 2023, 09:00 AM

Share

The dividend of coal and energy mining issuers led by tycoon Garibaldi Thohir, PT Adaro Energy Indonesia Tbk. (ADRO) falls today, Friday (30/12/2022). ADRO will distribute dividends of US$ 500 million or equivalent to Rp7.79 trillion (estimated jisdor exchange rate of Rp15,594 per share).

dividend is the last date an investor is entitled to dividends. If you buy ADRO shares past that date, the new shareholders will not be entitled to dividends.

Adaro's dividend is equivalent to US$0.016 per share or Rp249.5 per share. However, the value in rupiah is still estimated, as Adaro has not yet announced the exchange rate for dividends.

ADRO's management in its official statement said that the value of this interim dividend is 67 percent higher than the 2021 interim dividend of US$ 300 million and is the highest interim dividend ever given by the company.

The schedule for ADRO's dividend distribution is dividend in the regular and negotiation market on December 30, 2022, with ex-dividend in the regular market and negotiations on January 2, 2023. Then, dividend in the cash market on January 3, 2023, and ex-dividend in the cash market on January 4, 2023.

The listing date of the company's shareholders who are entitled to an interim dividend or recording date is on January 3, 2023, the announcement of the conversion rate using BI's middle rate is on January 3, 2023, and the interim dividend distribution is on January 13, 2023.

ADRO President Director Garibaldi Thohir or Boy Thohir said providing returns to shareholders in the form of profit growth, dividends, and share buybacks, is ADRO's focus. He continued strong coal prices and efficient operational performance in 2022 supporting solid performance until September 2022.

"ADRO's profitability supports accelerating business transformation and provides consistent and attractive returns to shareholders," he said.

As of the third quarter of 2022, ADRO recorded operating EBITDA of US$3.8 billion and core profit of US$2.3 billion, 231 percent and 262 percent higher than the same period in 2021.

The cash position at the end of 9 months of 2022 was US$3.3 billion, 122 percent higher compared to the previous year. ADRO also posted net cash of US$1.8 billion compared to net debt of US$10 million in 9 months of 2021.

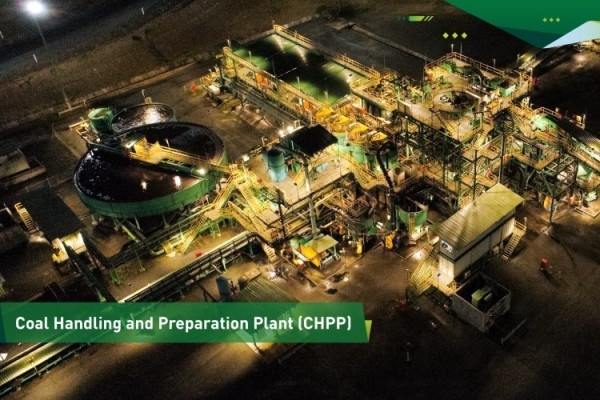

Image source: PT Adaro Energy Indonesia Tbk