Electric vehicles are fueling Indonesia’s green IPO boom

Fri 13 Oct 2023, 08:00 AM

Share

Indonesia isn’t exactly a stock trading hotbed. No other Southeast Asian country has a smaller market for equities relative to the size of its economy, according to the International Monetary Fund.

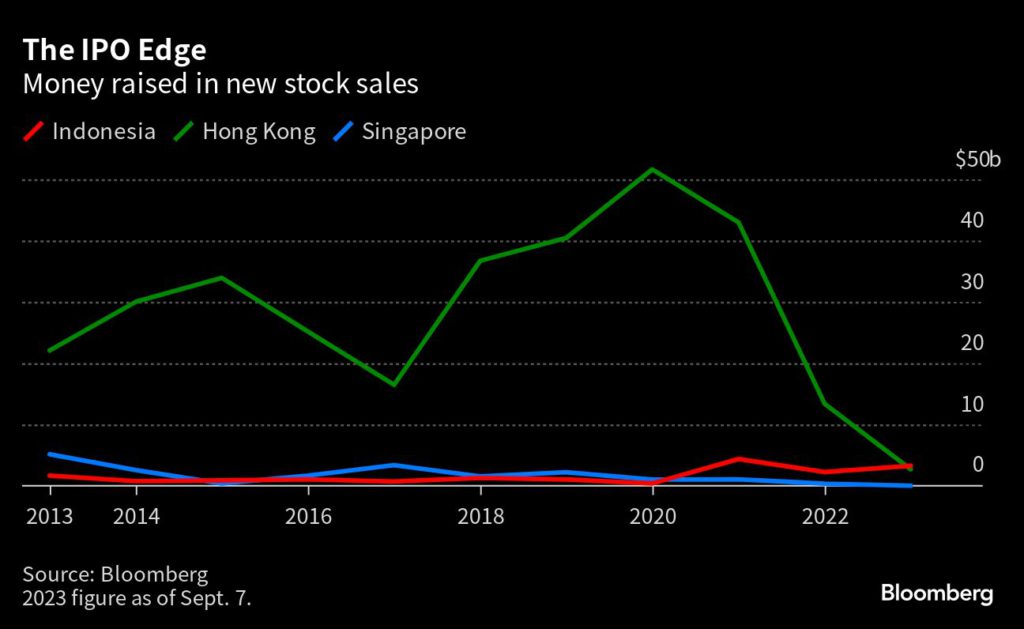

So it came as something of a surprise when Indonesia emerged this year as one of the world’s strongest markets for initial public offerings. In a 20-week span alone, companies raised $2.4 billion from first-time stock sales. That’s almost as much as Hong Kong and Singapore combined. Year to date, Indonesia ranks No. 4 globally, trailing only China, the US and the United Arab Emirates.

Why the boom? It’s part of the frenetic rush to move away from fossil fuels and into green energy. Indonesia is the world’s No. 1 miner of nickel, a key metal in the production of the batteries needed to power electric vehicles, forklifts and lawnmowers. The country also has significant reserves of cobalt, copper, gold and tin.

As a result, Jakarta, Indonesia’s capital and largest city, has seen a flood of interest from foreign investors who’d rarely made trips there before last year. “It was hard to get someone from London, Hong Kong or Singapore to come here,” says Irwanti (many Indonesians are known by a single name), chief investment officer of Schroders Indonesia in Jakarta. “Now some of them have come for a visit three or four times within a year, looking for good ideas.”

Indonesia’s rise represents a special challenge for neighboring Singapore because companies in the region are increasingly looking to raise money in their domestic markets. That shift has a disproportionate impact on Singapore, which is a big city but a small nation. Money raised from IPOs has nearly disappeared so far this year, dropping 95% compared with the same period in 2022, to just $18.6 million. With liquidity drying up in the Singapore stock market, even homegrown companies have looked elsewhere. They included some unicorns, or startups valued at $1 billion or more, such as Singapore’s Sea Ltd., an online marketplace that listed in New York.

Singapore is fighting to reclaim its market share. Last year the stock exchange, which declined to comment, tried to court Chinese companies seeking alternatives to a US or Hong Kong listing, as well as those looking to raise their profiles in Southeast Asia. Authorities have also set up a S$1.5 billion ($1.1 billion) fund backed by Singapore’s state investment company Temasek Holdings Pte to invest in high-growth companies and IPOs.

For now, Indonesia has some powerful advantages. It has a population of about 280 million, the fourth-largest in the world, which provides a base of retail as well as institutional investors. Its $1.3 trillion gross domestic product is the largest in Southeast Asia.

In a country blessed with natural resources, the vast bulk of IPOs this year came from expansion-minded metals companies, such as PT Trimegah Bangun Persada, also known as Harita Nickel, the first Indonesian company to process low-grade nickel ore into battery-grade metal. The government is also investing heavily in becoming more of a manufacturer, rather than just a supplier, of raw materials.

Indonesia’s strong economy has helped, too. Its GDP is expected to expand 5% in 2023, outpacing the 4.7% growth forecast for Asia, not including Japan. The Indonesian rupiah is the region’s best-performing currency this year after the central bank drove borrowing costs to a four-year high.

“That provides the confidence for capital market participants, both domestic and international, to be a part of the growth journey,” says Sunil Khaitan, head of equity capital markets for Southeast Asia at Bank of America Corp. in Singapore. Indonesia is also benefiting from the search for investment alternatives beyond China, which is struggling to revive its economy.

Still, the Indonesian IPO market faces challenges. Deals tend to be relatively small. Almost 92% of the 66 listings this year raised less than $100 million, a size unlikely to register on the radar of larger institutional investors.

Trading is also limited. Regulators require that only 7.5% of a listing be available to the public for trading. This small “free float” can make stocks volatile and unattractive to investors. Singapore, by contrast, requires 10%; India, 25% within three years of listing; Hong Kong, 25% for smaller companies and 15% for those whose market values are less than HK$10 billion ($1.3 billion). “Indonesia tends to be a lot less liquid than some other markets,” says Bank of America’s Khaitan.

Some bankers note that fundraising activity may slow as Indonesia gears up for a general election in February. Although local and foreign players expect market-friendly policies to remain in place, some companies have already put their IPO plans on hold. They include PT Pertamina Hulu Energi, a unit of state-owned energy company Pertamina that had been expected to be one of Indonesia’s biggest IPOs this year. The listing of a 10% stake was projected to raise at least $2.5 billion.

Similarly, agriculture company PalmCo postponed an offering to the second quarter of next year to give its parent more time to finalize the integration of four subsidiaries. The company had initially planned to raise as much as $666 million by yearend. “We would need to wait until at least the first quarter of 2024, if not the second quarter, to see the pipeline picking up again,” says Anthonius Sehonamin, managing director and head of integrated corporate bank at Citi Indonesia.

Overall, there are signs to suggest Indonesia’s share sales are gaining acceptance outside the country. They’re drawing interest from Masdar, the United Arab Emirates’ main renewables company, regional sovereign wealth funds and international investors.

“I can’t think of a better time to be an investment banker in Indonesia,” says Ranju Parambi, head of global banking for Indonesia at UBS Group, the joint-lead manager in four deals that raised a total of about $2 billion this year. “The trajectory is very clear. It is upwards.”

Image source: Stock image

Source: www.mining.com/Electric Vehicles Are Fueling Indonesias Green IPO Boom

Source: https://www.mining.com/web/electric-vehicles-are-fueling-indonesias-green-ipo-boom/