Indonesia Still Dominates Nickel Market Despite Price Plunge in 2025

Mon 17 Feb 2025, 08:38 AM

Share

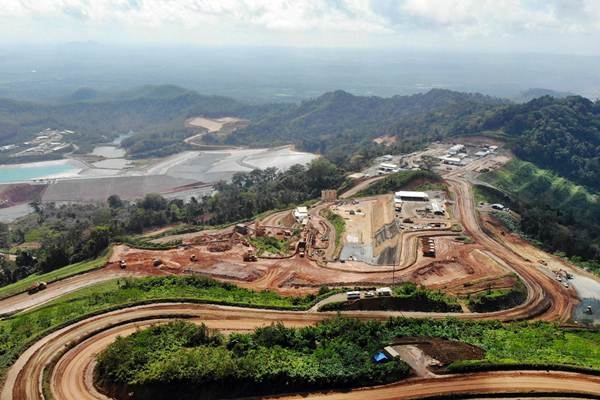

Indonesia continues to be a major player in the global nickel industry despite a significant drop in commodity prices over the past two years. The country has maintained high production levels while facing challenges from environmental regulations and global market uncertainty.

According to data from S&P Global, the price of nickel in 2025 reached USD 15,078 per metric ton, the lowest point since 2020. Throughout 2024, the average price was USD 15,328 per metric ton, down 7.7% from the previous year. The main factors driving this decline include the strengthening of the US dollar, US-China trade tensions, and a global supply surplus.

As the world's largest nickel producer, Indonesia continues to increase its production. Data from the Indonesian Nickel Miners Association (APNI) indicates that national production is projected to reach 298.5 million wet metric tons in 2025, up from 272 million metric tons the previous year. This increase in production is contributing to the global supply surplus, which is expected to reach 156,000 metric tons this year.

Despite the ongoing price decline, some Indonesian nickel producers remain optimistic about long-term demand, particularly from the electric vehicle (EV) industry. However, the industry's reliance on the Chinese market remains a key concern. Chinese companies currently control about 75% of nickel refining capacity in Indonesia, which increases the risk of supply chain instability.

Additionally, tightening environmental protection policies are beginning to impact Indonesia's nickel industry. The government is considering implementing stricter regulations for companies that fail to meet sustainability standards. Some producers are even reportedly planning to import nickel ore from the Philippines to comply with the new regulations.

Meanwhile, the economic impact of the US-China trade war is affecting nickel demand. The additional 10% tariff announced in January 2025 could pressure the nickel-based industrial sector, especially in China and other countries dependent on Indonesian nickel exports.

On the other hand, while the nickel market faces short-term pressure, long-term projections still show potential for recovery. Market analysis suggests that the compound annual growth rate (CAGR) of nickel demand is expected to reach 5.1% through 2035, higher than the 4.6% growth in supply.

With these projections, a supply deficit is expected to occur by 2030, potentially driving nickel prices higher in the future. This presents an opportunity for Indonesia to maintain its market leadership and encourage further investment in the nickel downstream industry.

Nevertheless, Indonesia's nickel industry still faces significant challenges in balancing high production, stringent environmental regulations, and global geopolitical dynamics. The government and industry players need to find sustainable strategies to ensure price stability and long-term growth, as reported by Saptakee in an article on carboncredits.com.

Source: https://www.dunia-energi.com/indonesia-tetap-mendominasi-pasar-nikel-meski-harga-anjlok-pada-2025/