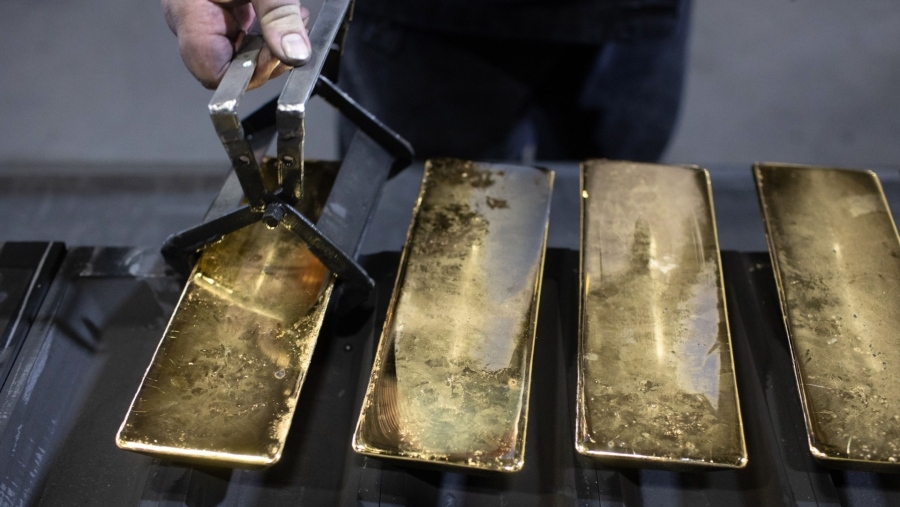

BRMS Plans to Raise USD 600 Million Loan for Gold Project Expansion

Wed 05 Nov 2025, 12:53 PM

Share

PT Bumi Resources Minerals Tbk. (BRMS) plans to raise a USD 600 million syndicated loan facility from foreign and local banks, equivalent to approximately IDR 10.03 trillion (Bank Indonesia Jisdor rate IDR 16,729 per US dollar), to support the company’s expansion plan.

President Director of BRMS, Agoes Projosasmito, explained that about half of the loan proceeds will be allocated to the underground gold mining project in Palu, Central Sulawesi.

Meanwhile, the remaining funds will be used for exploration activities and the construction of a processing plant at Gorontalo Minerals, as well as a plant at Linge Mineral Resources, which manages gold and silver mines.

“If possible, I will draw down the loan by the end of this month so we can quickly secure the funds, complete the plant, finish the underground mining project, and start production soon,” said Agoes in Jakarta, Wednesday (November 5, 2025).

According to him, BRMS’s financial position is solid enough to meet its loan obligations. As of the third quarter of 2025, BRMS booked operating profit of USD 69.71 million, with net profit up 129 percent year on year to USD 37.61 million.

Operationally, the gold mining issuer recorded EBITDA of USD 76 million, up 121.2 percent year on year through the end of September 2025.

With the underground mine in Palu coming on stream, BRMS expects EBITDA to rise to USD 150 million to USD 200 million, which is seen as keeping loan payments manageable.

“Once the underground mining is added, our EBITDA will be around USD 200 million. If EBITDA is USD 200 million or even USD 150 million, then a USD 600 million loan is easy to service,” Agoes concluded.

Based on the financial statements for the end of September 2025, the company affiliated with the Salim Group and the Bakrie Group posted a 69 percent year on year increase in revenue, from USD 108.47 million to USD 183.57 million.

BRMS Director and Chief Financial Officer, Charles Gobel, stated that the company’s improved financial performance was driven by two main factors, namely higher production volume and higher gold selling prices.

“Our gold production rose 25 percent from 45,366 oz in the third quarter of 2024 to 56,552 oz in the third quarter of 2025. Second, the gold selling price also increased by 34 percent from USD 2,347 to USD 3,156,” he said, Wednesday (October 29, 2025).

On a quarterly basis, BRMS’s performance remained relatively stable. Revenue in the third quarter of 2025 reached USD 62.7 million with net profit of USD 15.35 million, up from USD 7.41 million in the previous quarter.

Gold production reached 17,558 oz in the third quarter of 2025, slightly higher than 17,071 oz in the second quarter of 2025. The gold grade in processed ore also increased to 1.5 grams per ton (g/t) from 1.4 g/t in the previous quarter.